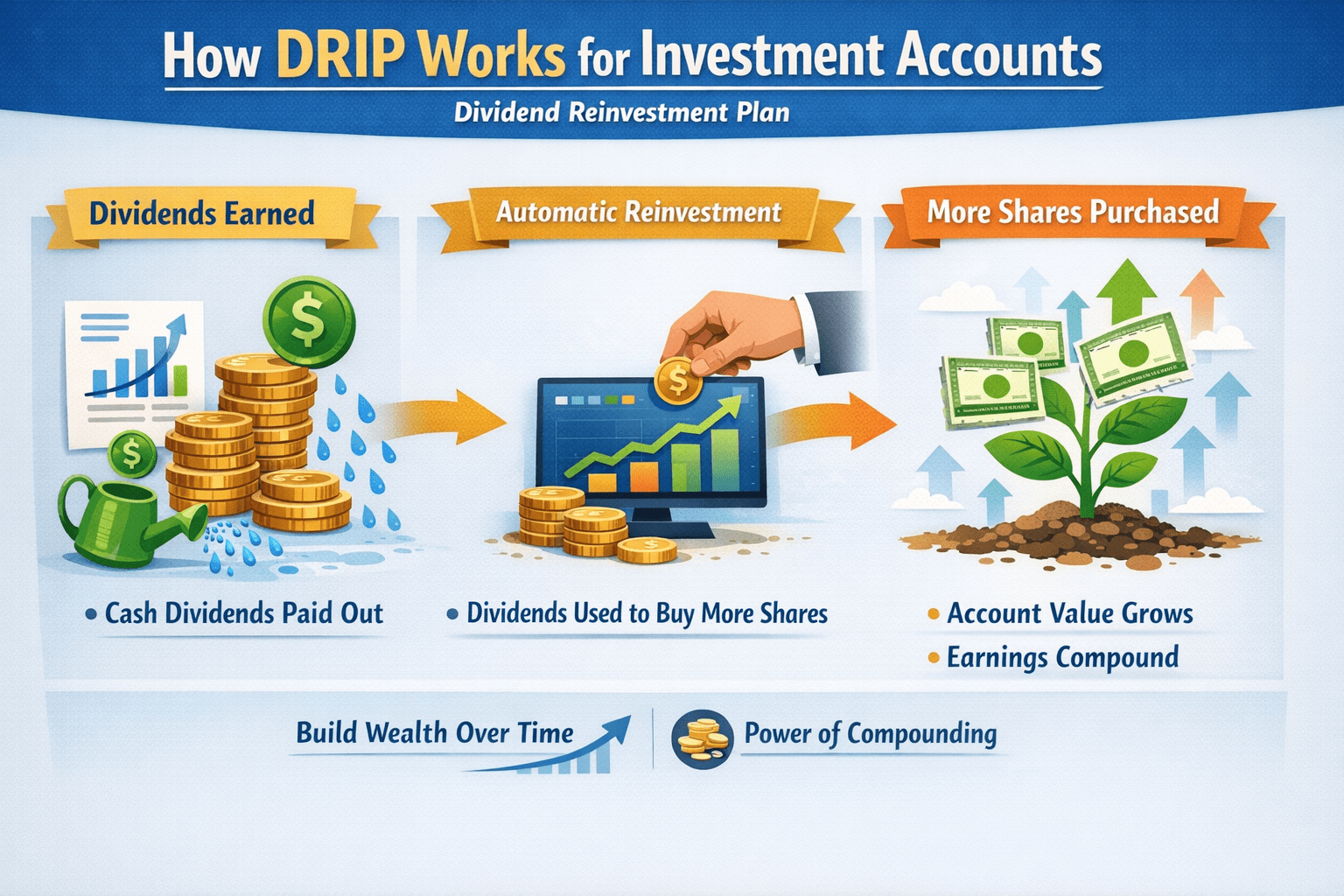

Drip, or, Dividend Re-Investment Program, is an automated feature available for holders of stocks that allows for dividends to be automatically used to buy more stock. A holder owns a stock, that stock issues dividends, and those dividends are used to buy more stock of that same security. Drip is a feature available in most brokerages allowing a user to toggle on and off per security.

There are many reports that Warren Buffet loves his dividends but does not use a drip. He instead keeps his dividends in cash and then makes fresh decisions on where to invest the new cash.

So why do or not do a drip?

In my opinion using a drip is great for 2 cases only:

- Stock is an ETF

- Holder wants to Set and Forget their portfolio

When you are in a fund or ETF then it is safe to use drip because the stock is less likely to have ups/downs around dividend dates. Stocks outside of funds tend to suffer ups and downs around dividend dates resulting is possibly overpaying for stock with your dividend money and then watching the stock decline. A holder who actively watches the market could potentially not use a drip and then wait until the stock is at a cost basis the holder prefers. Most people don’t actively watch their holding that close nor do they have the insights to accurately perform these steps for a gain.

If someone loves their portfolio they may choose to set and forget using drip. If the holder has stocks like Coke, Pepsi, AT&T*, most Big Oil like Chevron and Exxon Mobil, large financials like Visa and Mastercard then I’d say do the drip. If the stock isn’t a so-called dividend favorite of the market then I wouldn’t use a drip.

* Disclosure: I own one or more of the securities mentioned in this article.